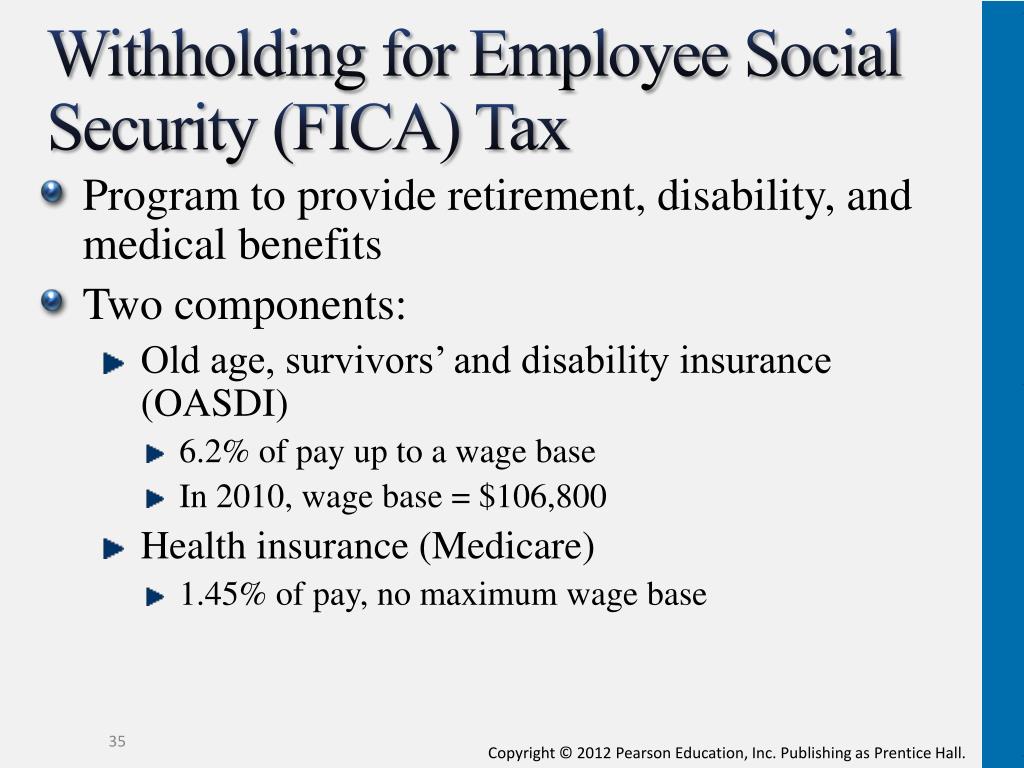

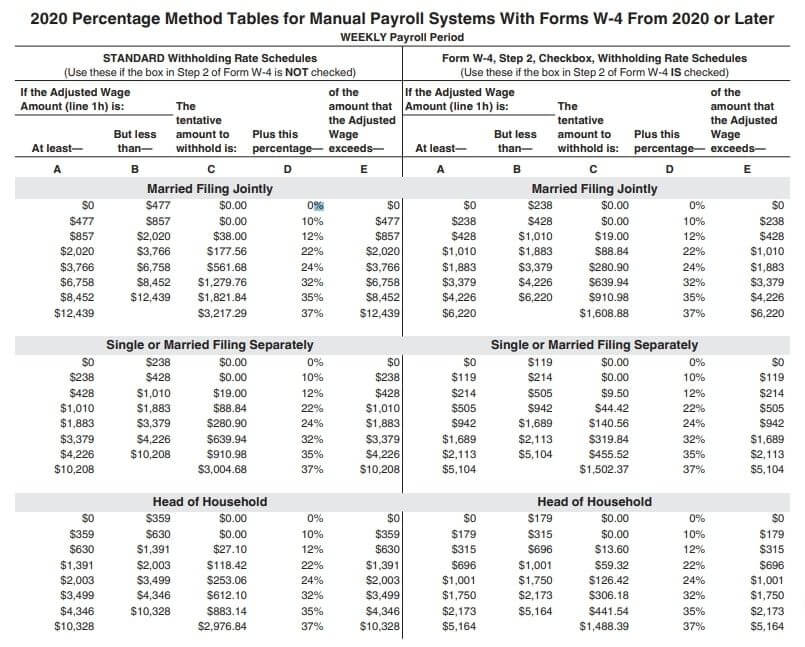

Medicare Withholding 2025 - Employers are responsible for withholding the tax on wages and rrta compensation in certain circumstances. Project 2025 proposes sweeping medicare changes, making medicare advantage default, cutting drug cost caps, and reshaping spending for donald trump’s second white. Tax Planning for Retirees Navigating the Medicare and Social Security, Fica is a payroll tax, and it's short for the federal insurance contributions act.

Employers are responsible for withholding the tax on wages and rrta compensation in certain circumstances. Project 2025 proposes sweeping medicare changes, making medicare advantage default, cutting drug cost caps, and reshaping spending for donald trump’s second white.

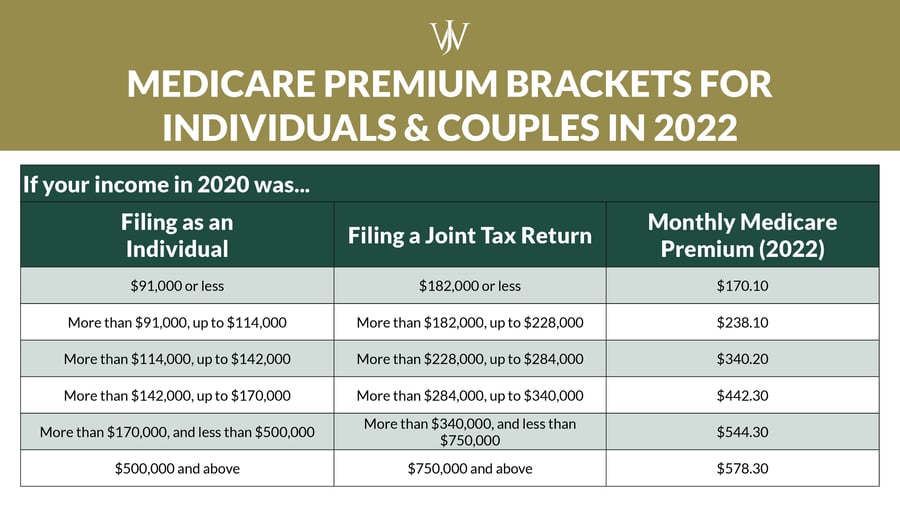

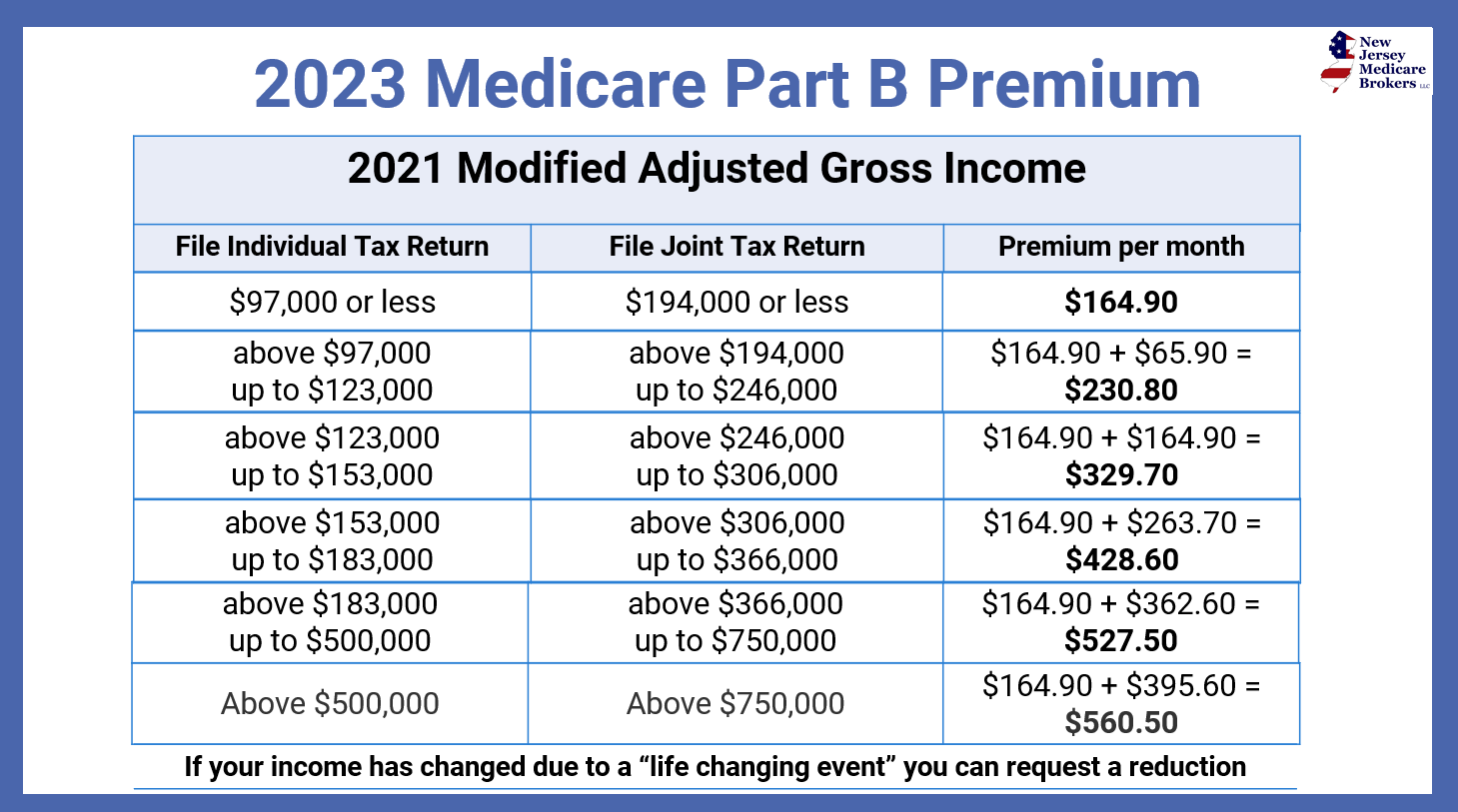

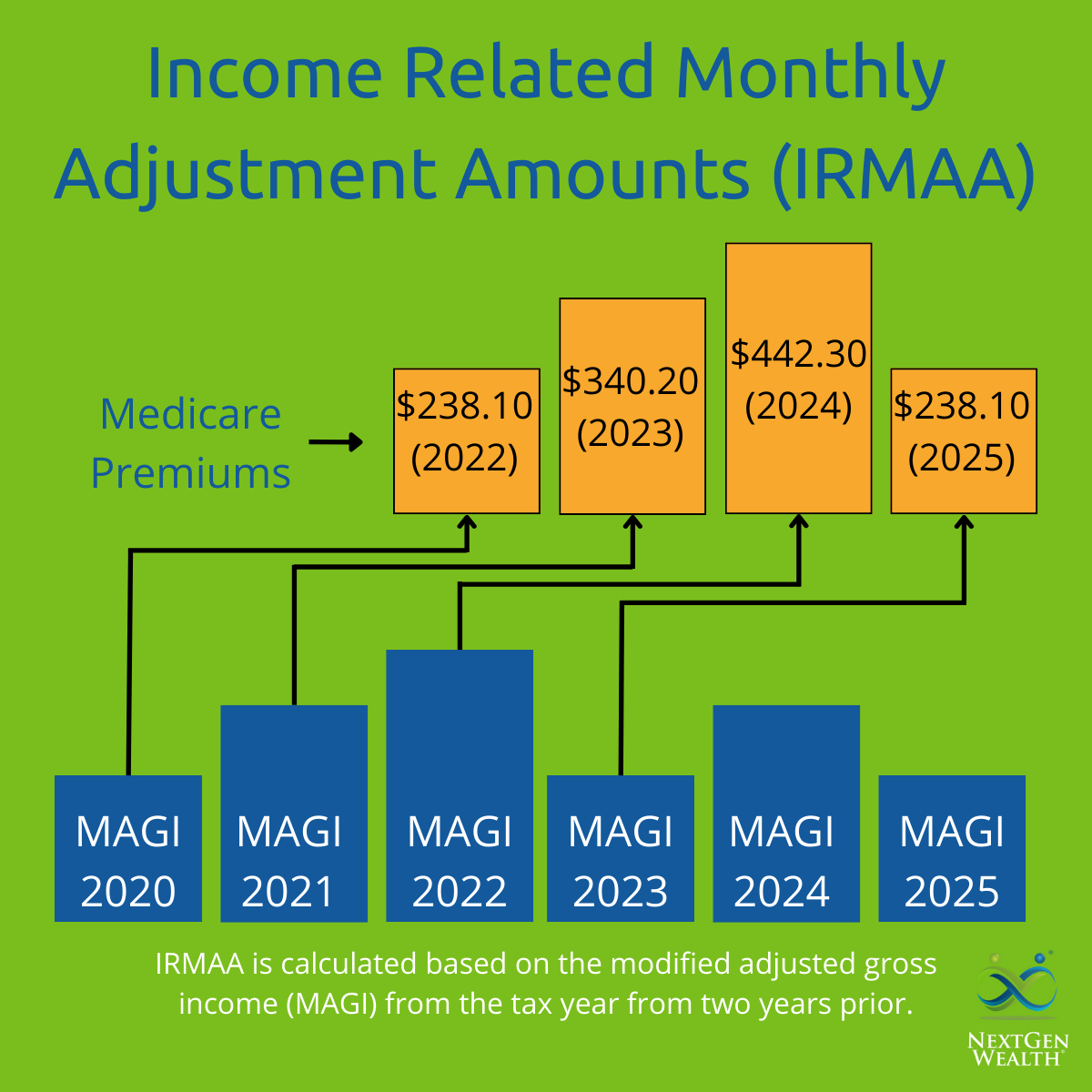

Medicare Premiums For 2025 Based On Tax Rate Zoe Lyman, The standard monthly premium for medicare part b — the part of medicare that covers doctor’s visits, routine cancer screenings, home health care and other outpatient.

2025 Medicare Withholding Rate Casey Cynthea, 2025 medicare part b premium amount.

IRMAA Brackets For 2025 What They Are And How They Affect Medicare, It’s vital to keep your budget.

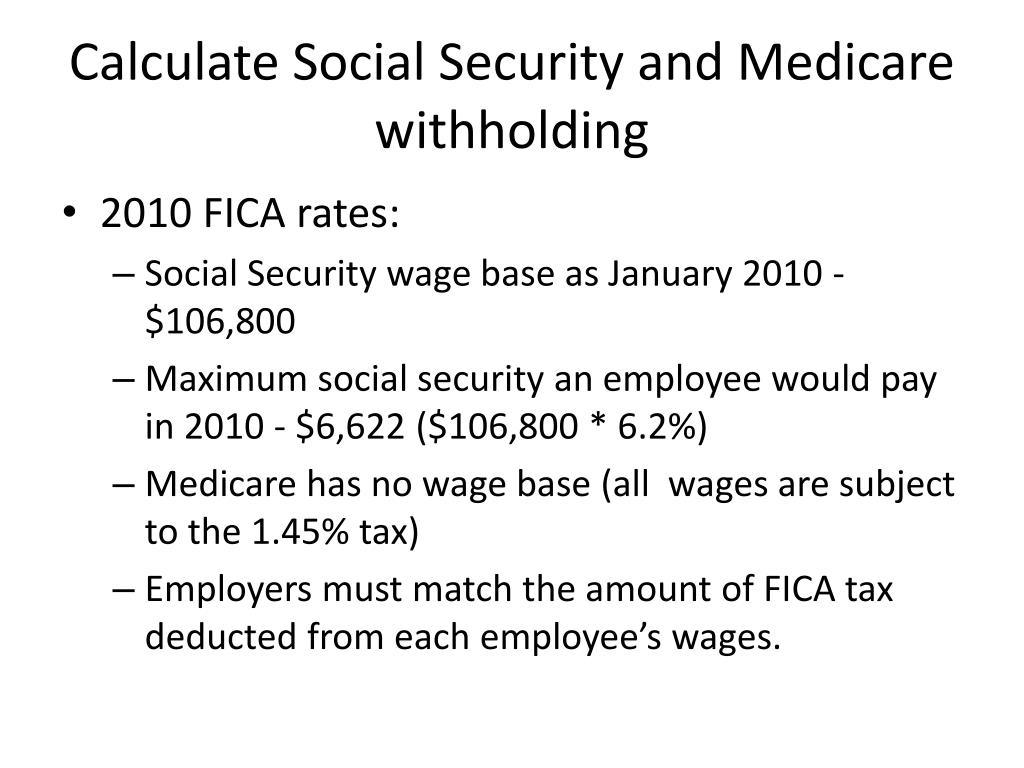

Fica And Medicare Withholding Rates For 2025 Withholding Juli Valentina, What is the rate of additional.

Additional Medicare Withholding Rate 2025 Medicare, The medicare tax rate for 2025 remains at 1.45% of all covered earnings for employers and employees.

Medicare Withholding 2025. 2025 medicare part b premium amount. Adjusting withholding ensures your medicare deductions fit your financial situation.

What Is The Fica Cap For 2025 Carl Morrison, The standard monthly premium for medicare part b — the part of medicare that covers doctor’s visits, routine cancer screenings, home health care and other outpatient.

Employer Fica And Medicare Rates 2025 Opm Sarah Short, Changes to social security and medicare benefits and premium calculations for 2025 have been announced.

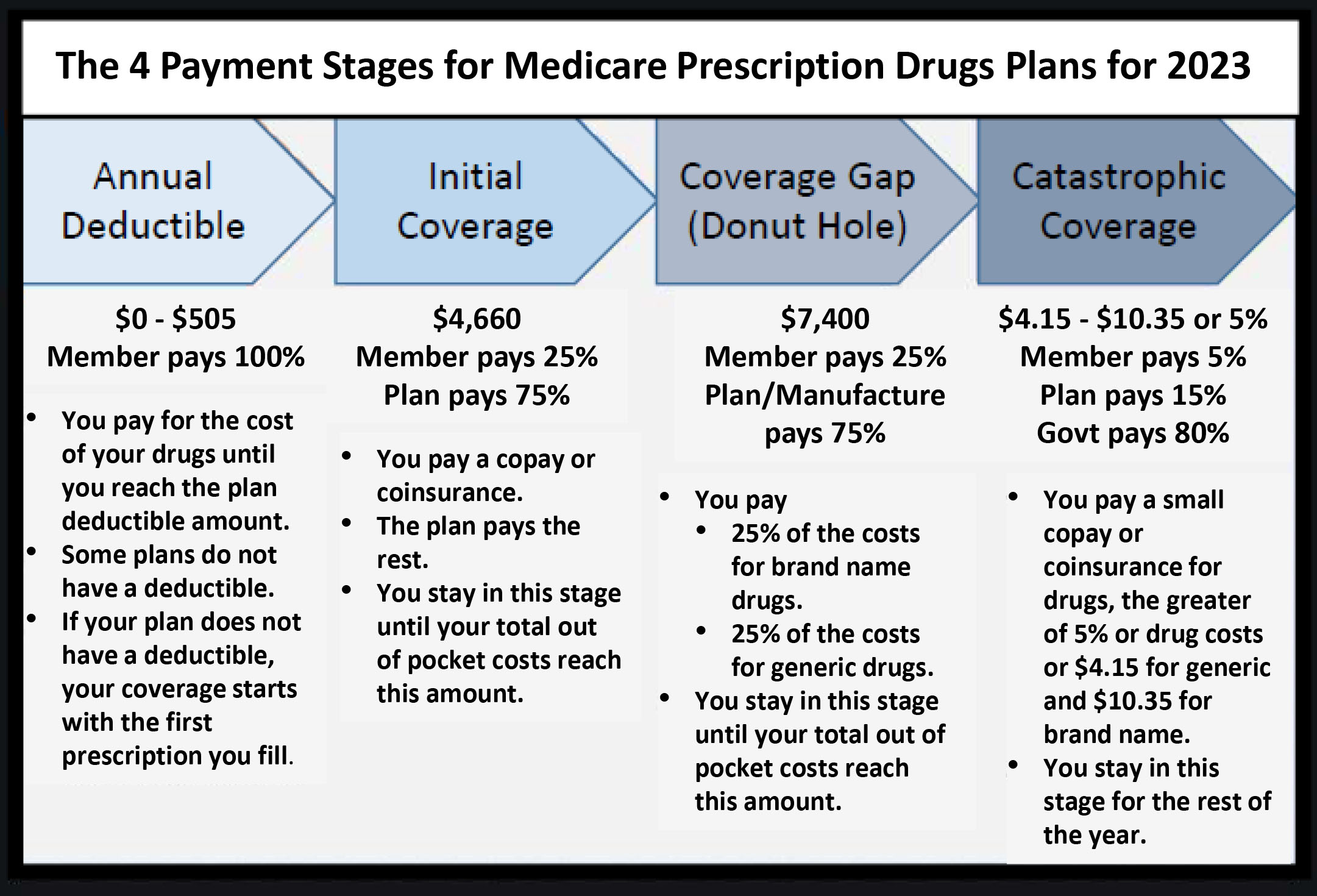

Medicare Part D Premium 2025 Increase 2025 Megan Knox, For 2025, the fica tax rate for employers will be 7.65% — 6.2%.