Gift Tax Exemption For 2025 - Gift Tax Limit 2025 Explanation, Exemptions, Calculation, How to Avoid It, A top republican lawmaker in california called for an investigation into governor gavin newsom ’s role in exempting. If they make good use of a portability election, a married couple could. IRS Increases Gift and Estate Tax Thresholds for 2023, As announced by the irs, the key 2025 federal transfer tax exemption amounts per taxpayer are as follows: Page last reviewed or updated:

Gift Tax Limit 2025 Explanation, Exemptions, Calculation, How to Avoid It, A top republican lawmaker in california called for an investigation into governor gavin newsom ’s role in exempting. If they make good use of a portability election, a married couple could.

Lifetime Gift Tax Exemption 2025 & 2023 Definition & Calculation, Gifting to family, friends, and others? If they make good use of a portability election, a married couple could.

Hecht Group The Annual Gift Tax Exemption What You Need To Know, Find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and. Estate & gift tax exemption:

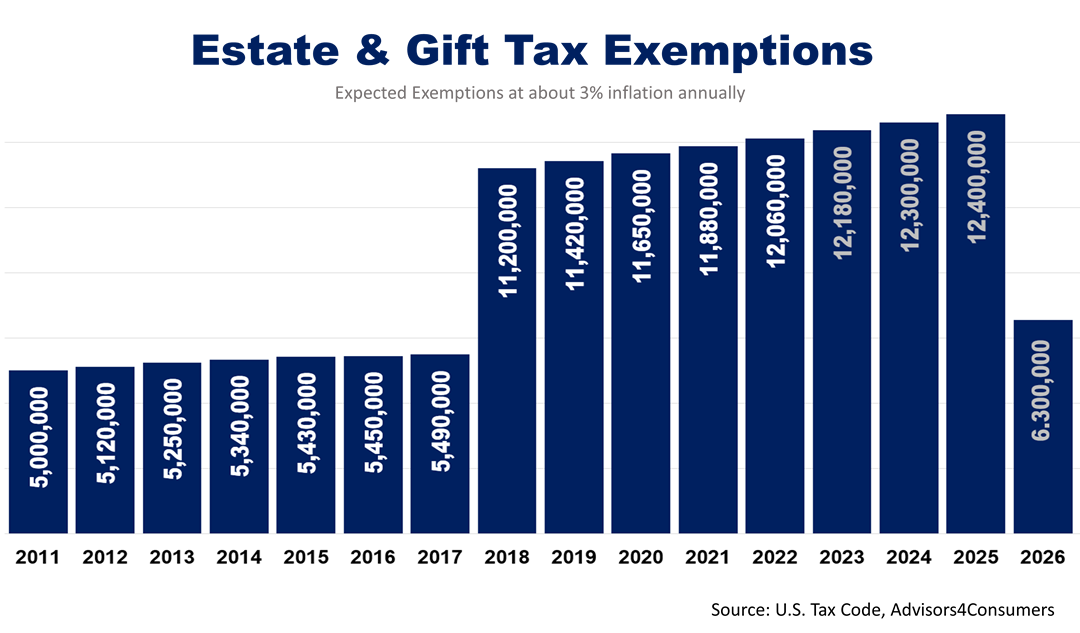

For 2025, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Though gift tax is applicable on gifts whose value exceeds rs.50,000, the gift is exempted from tax if it was given by a relative. But numerous exceptions apply to this rule, which will be discussed below.

Federal Estate and Gift Tax Exemption set to Rise Substantially for, The gift tax limit is $18,000 in 2025. For 2025, the annual gift tax exemption is $18,000, up from $17,000 in 2023.

The pandemic temporarily allowed the historical 50% tax deduction for business meals to be increased to a 100% tax. Generally, any gift is a taxable gift.

Gift Tax Exemption For 2025. Each year, the irs sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2025, $18,000) per. But numerous exceptions apply to this rule, which will be discussed below. For 2025, the annual gift tax exemption is $18,000, up from $17,000 in 2023.

For the 2025 tax year, taxpayers can deduct $14,600 if they are single and $29,200 if they are married and file jointly.

Increases to 2023 Estate and Gift Tax Exemptions Announced Varnum LLP, Estate & gift tax exemption: Updates to business meal deductions.

How Smart Are You About the Annual and Lifetime Gift Tax Exclusions, Updates to business meal deductions. The pandemic temporarily allowed the historical 50% tax deduction for business meals to be increased to a 100% tax.