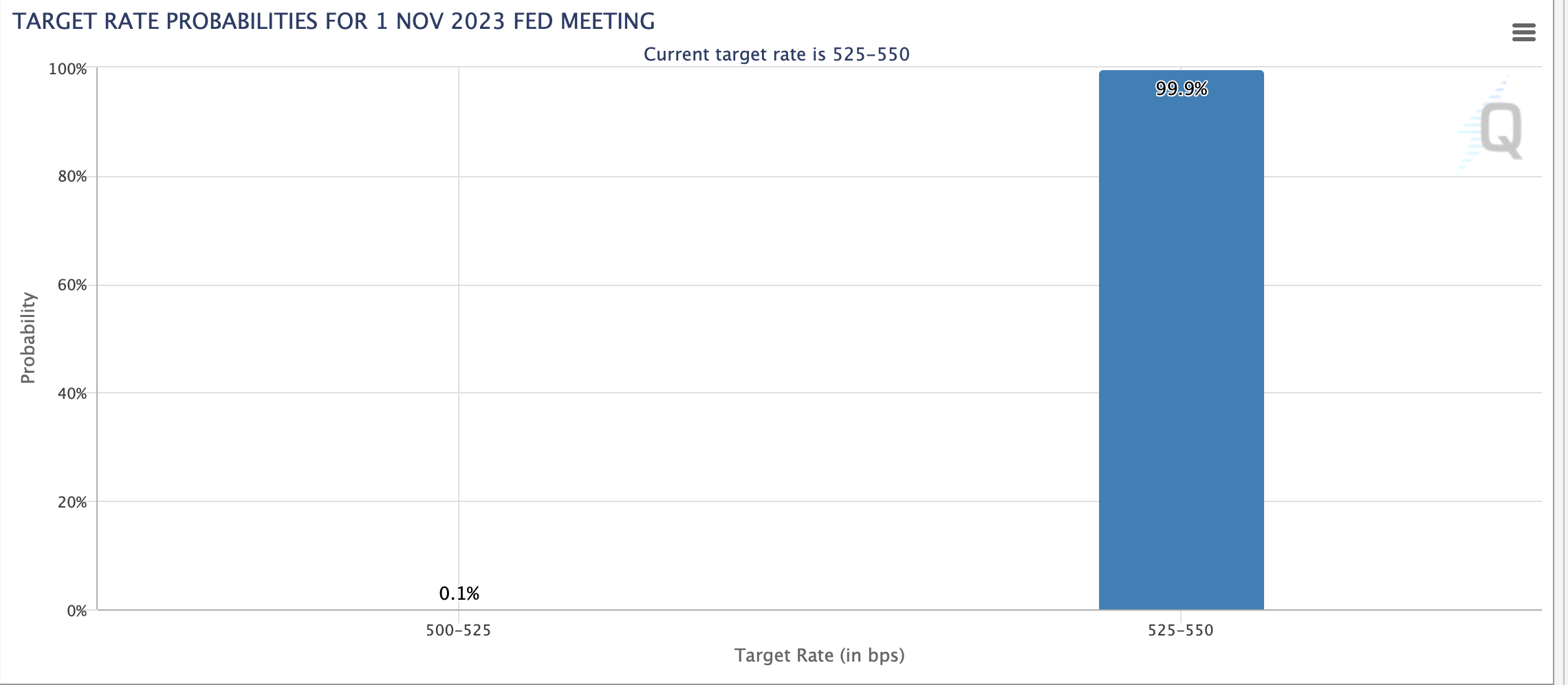

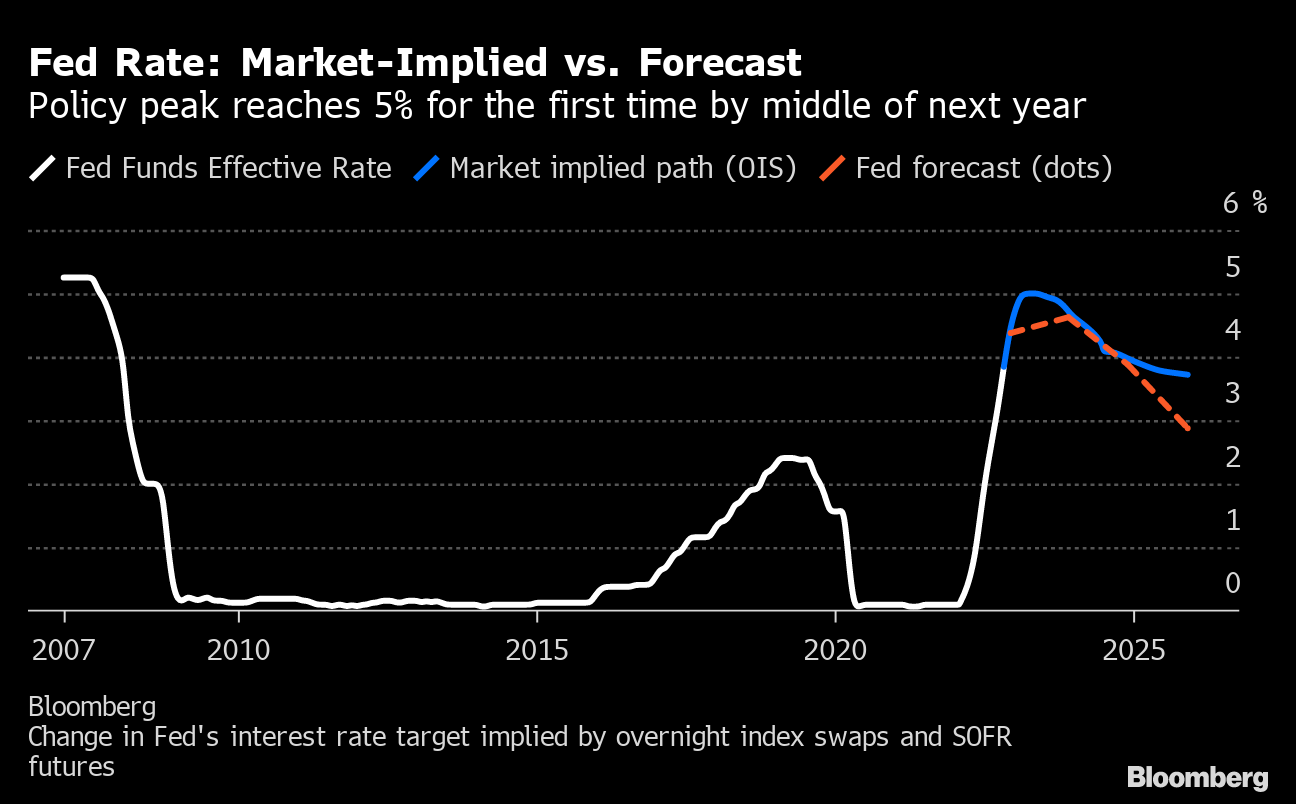

Fed Interest Rate Calendar 2025 - Investors are eyeing a number of scenarios for 2025. The federal reserve’s target rate probabilities for the end of 2025, published by the cme group, reflects the market’s expectations for the fed’s interest rate levels in 2025. Fed Interest Rate Calendar 2025. The fed trimmed a key interest rate by a quarter percentage point, its third straight rate cut. Here's what to expect for savings and cd rates as we approach the new year.

Investors are eyeing a number of scenarios for 2025. The federal reserve’s target rate probabilities for the end of 2025, published by the cme group, reflects the market’s expectations for the fed’s interest rate levels in 2025.

Will The Fed Raise Interest Rates In September 2025 Esther Henrieta, Investors are eyeing a number of scenarios for 2025.

Fed Calendar Interest Rates Peta Trudey, Here's what to expect for savings and cd rates as we approach the new year.

Eyes on the Fed Interest Rate Decision in Global Markets, The interest rate was lowered 0.25 percentage points in december.

Chart Fed Projections Suggest Three Rate Cuts in 2025 Statista, Graph and download economic data for fomc summary of economic projections for the fed funds rate, range, low (fedtarrl) from 2025 to 2027 about projection,.

Fed Fomc Calendar 2025 Evita, The interest rate was lowered 0.25 percentage points in december.

Calendar Event Bali 2025. In 2025, bali offers visitors a full calendar of captivating events—each […]

Free Printable 2025 Calendar For Kids. Click on the button below to download your free […]

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/24042678/UzzuD_the_fed_has_been_raising_interest_rates_for_months.png)

When Should the Fed Stop Raising Interest Rates? Econofact, However, the question remains how much and how fast.

Fed Rate Decision December 2025 Tessa Gerianna, The interest rate was lowered 0.25 percentage points in december.

Fed Interest Rate Dates 2025 Letti Willie, New york (ap) — the federal reserve’s third interest rate cut of the year will likely have consequences for debt, savings, auto loans, mortgages and other forms of borrowing by.